About 528 Partners

528 Partners is a strategic investment firm specializing in building scalable platforms in the home services sector. 528 Partners team’s collective experience spans decades in acquisitions, finance, marketing, and operational leadership. We’ve strategically aligned our independent strengths into a unified process that streamlines deal sourcing, operational integration, and value creation—resulting in high-return opportunities for our investors.

Our Story

528 Partners was formed to solve a major challenge in the lower middle market: creating platform companies that meet the scalability criteria of private equity firms and strategic buyers. While 528 Partners was formally established recently, our core team has been collaborating and refining this model for over four years. Each member brings deep expertise and a proven track record in their respective fields.

- Beau and Doug have worked together for four years in the deal brokerage space and have been collaborating for over a decade in training and marketing.

This deep-rooted collaboration enables us to execute our strategy with precision and speed, setting us apart from newly formed entities.

What We Do

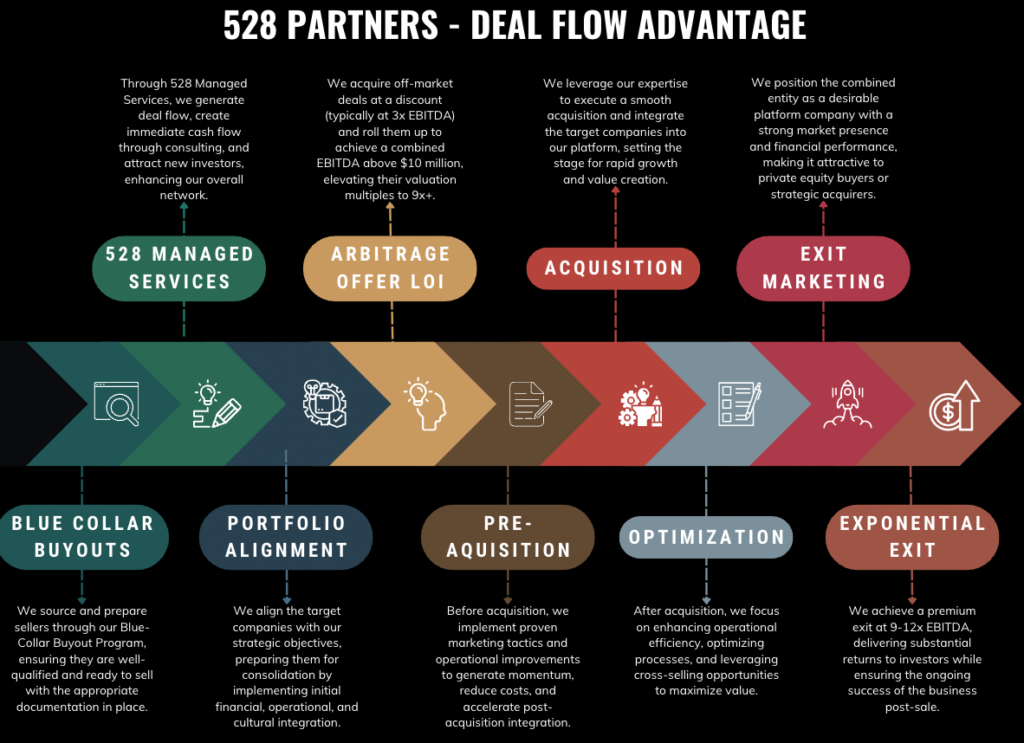

Our unique strategy called the 528 Partners Arbitrage Bridge, is designed to bridge the gap between fragmented small businesses and the robust platform companies sought by private equity. By combining multiple off-market acquisitions, we create a single, well-functioning entity that meets the size and scalability criteria for higher valuations.

Acquire Undervalued Companies

We identify and secure off-market businesses at a discount (typically 3x EBITDA).

Create a Platform Entity:

Through strategic integration and alignment, we consolidate these companies to achieve a combined EBITDA above $10 million.

Enhance Value:

The result is a platform company trading at a higher multiple (9x EBITDA or greater), creating immediate value for investors.

Our Expertise

Our team’s unique blend of expertise spans the entire deal lifecycle—from sourcing and structuring acquisitions to operational integration and exit planning.

Our deep experience allows us to move quickly through acquisition, integration, scaling, and exit—maximizing value creation at each stage.

Beau Haralson

CEO

With nearly 20 years of managing on average 30 companies across portfolios at a time, Beau has managed over $250M in growth capital and overseen multiple exits and acquisitions. He has built and sold several companies from the ground up, and has consulted Southwest Airlines, Nike, Google, Twitter (now X), Netflix, the World Expo, and early stage companies on unique growth strategies and beyond. He and his wife of 16+ years and 2 children reside in Colorado where they play in the mountains as much as possible.

Doug Foley

CSO

Doug Foley specializes in creative financing solutions for acquiring and growing businesses. As Chief Marketing Officer at COTE Capital, Doug was instrumental in developing the “IP Capital” model, revolutionizing how companies leverage intellectual property for growth. An international best-selling author and TEDx speaker, Doug's expertise spans marketing, financing, and scaling businesses, enabling him to craft innovative strategies that drive sustainable growth and unlock potential for high-growth companies and their investors.

The 528 Partners Process

Our Vision: Creating Abundance Through Strategic Value Creation

Our vision is centered on creating abundance for everyone involved, from the operators on the front lines to the investors fueling growth. We bridge the gap between fragmented, individually owned companies and scalable platform entities that attract private equity interest.

Our model isn’t just about acquisitions—it’s about transformation. We’ve built our strategy on a foundation of proven partnerships and a deep understanding of the home services market, crafting a process that elevates businesses and delivers superior returns.

Our Track Record: Built on Decades of Success

While 528 Partners may appear new, our model is the culmination of more than a decade of successful collaborations and strategic execution. Each team member brings extensive experience in deal sourcing, operational optimization, and scaling businesses for high-value exits.

How We Create Value:

- Assemble Portfolios Faster: We leverage our extensive network and deep industry expertise to source and align the right companies swiftly.

- Prepare Businesses for Acquisition: Through rigorous training and strategic planning, we ensure each business is ready for a seamless transition, making them attractive to potential buyers.

- Streamline Operations for Better Integration: Our methodical approach to integrating businesses maximizes efficiency and reduces friction, setting the stage for rapid growth.

- Position Companies for Premium Exits: We elevate the EBITDA multiple through operational excellence and market positioning, allowing us to target high-value exits at 9x or greater.

The 528 Partners Wealth Wheel: Creating Value at Every Stage

Our strategy is structured around a unique model we call the 528 Wealth Wheel, where each stage of business ownership is elevated to create a cycle of growth and reinvestment:

- Operator – We provide training, mentorship, and resources to help skilled operators transition into ownership roles, fostering entrepreneurship and setting the foundation for growth.

- Owner – Through strategic planning, operational optimization, and marketing support, we help owners scale their businesses, increase profitability, and expand their market presence.

- Exit/Advisor – We guide owners through exit planning, valuation enhancement, and smooth transition processes, ensuring they maximize the return on their investment.

- Investor – After a successful exit, we provide former owners with opportunities to reinvest and grow their wealth further, creating a cycle of economic prosperity and ongoing value creation.

Our process creates not just business value, but personal and financial abundance for every stakeholder involved, setting a new standard in home services investments.

Our team’s combined expertise in sourcing, structuring, scaling, and exiting businesses, coupled with our innovative approach, positions us as leaders in building platform companies that outperform traditional investment models. Together, we are transforming the home services industry, one high-value exit at a time.